Globally, governments are seeking to reduce the prevalence of bribery and corruption in business dealings.

Effective internal controls, ethics, and compliance programs are essential to minimising or preventing the costs, legal consequences and reputational damage associated with corruption or the perception of corruption within your organisation.

On completing this course, learners should be able to:

- understand the consequences of a breach;

- identify how bribery and corruption can be prevented;

- understand how to comply with bribery and corruption laws;

- understand local enforcement;

- outline guidelines for multinational enterprises; and

- understand their obligations relating to both local and relevant international anti-bribery and corruption laws.

- understand the consequences of a breach;

- identify how bribery and corruption can be prevented;

- understand how to comply with bribery and corruption laws;

- understand local enforcement;

- outline guidelines for multinational enterprises; and

- understand their obligations relating to both local and relevant international anti-bribery and corruption laws.

- The law

- Bribes through third parties

- Receipt of bribes

- Facilitation payments

- Corruption

- Third parties

- Gifts and hospitality

- Bribery and corruption risks

- Keeping records

- Sign-off

- Who is responsible when a bribe occurs

- Reporting suspected foreign bribery

Bullying, discrimination and sexual harassment can cause major harm to the wellbeing of individuals. It can have an impact on an individual’s health and happiness, affecting their ability to do their job. Breaches can incur heavy costs for organisations, including fines, loss of reputation and high levels of employee turnover.

Safetrac’s ‘Anti-Bullying and Anti-Harassment’ course provides organisations and their employees with a general understanding of what behaviours are lawful and unlawful in the workplace

On completing this course, learners should be able to:

- understand what is meant by the terms bullying and harassment;

- understand how bullying and harassment occurs and its impact;

- understand how to respond to instances of alleged bullying or harassment; and

- outline the resolution procedures available.

- Harassment

- Sexual harassment

- Away from the workplace

- Types of unlawful harassment

- Racial harassment

- Bullying

- Cyberbullying

- What is not bullying?

- Things you can do

- Dealing with complaints

- Investigations

Understanding competition law, regulations in your jurisdiction, and your obligations is essential to all businesses regardless of size or business structure.

Cartels (where firms agree not to compete with one another) are a serious violation of competition law. Cartels injure customers by raising prices and restricting supply.

- understand what conduct is considered anti-competitive;

- understand the obligations of the employer and the employee under the relevant Act; and

- understand the terms cartel, price fixing, output restrictions and bid rigging.

- When does anti-competitive conduct arise?

- What is an anti-competitive arrangement?

- Depending on the jurisdiction, topics covering:

- Cartel conduct

- Output restrictions

- Market sharing

- Bid rigging

- Third line forcing

- Price fixing

- Resale price maintenance

- Exclusive dealing

- Misuse of market power

- Anti-competitive agreements

- Mergers and acquisitions

The International Monetary Fund (IMF) and the World Bank estimate that around 3-5% of global GDP, or around $3 trillion, is laundered worldwide every year.

Anti-Money Laundering and Counter Terrorism Financing (AML/CTF) laws and regulations are there to tackle money laundering and the financing of terrorism. They also target activities that include market manipulation, trade of illegal goods, corruption and evasion of tax, as well as all activities that aim to conceal these deeds

On completing this course, learners should be able to:

- understand what money laundering is;

- understand what counter-terrorism financing is; and

- explain their responsibilities under the law.

- What is money laundering?

- What is terrorism financing?

- Differences

- Depending on the jurisdiction, topics covering:

- The law

- The AML/CTF compliance program

- Limited expectations

- Collection information

- Beneficial owners

- Customer due diligence

- Reporting

- Penalties

- Keeping records

- What a reporting entity must do

- The activity-based approach

- The risk-based approach

- AML/CTF risk assessment

- Prescribed transaction reporting

The International Monetary Fund (IMF) and the World Bank estimate that around 3-5% of global GDP, or around $3 trillion, is laundered worldwide every year.

Anti-Money Laundering and Countering Financing of Terrorism (AML/CFT) laws and regulations are there to tackle money laundering and the financing of terrorism. They also target activities that include market manipulation, trade of illegal goods, corruption and evasion of tax, as well as all activities that aim to conceal these deeds.

On completing this course, learners should be able to:

- understand what money laundering is;

- understand what counter-terrorism financing is; and

- explain their responsibilities under the law.

- What is money laundering?

- What is terrorism financing?

- Differences

- Depending on the jurisdiction, topics covering:

- The law

- The AML/CFT compliance program

- Limited expectations

- Collection information

- Beneficial owners

- Customer due diligence

- Reporting

- Penalties

- Keeping records

- What a reporting entity must do

- The activity-based approach

- The risk-based approach

- AML/CFT risk assessment

- Prescribed transaction reporting

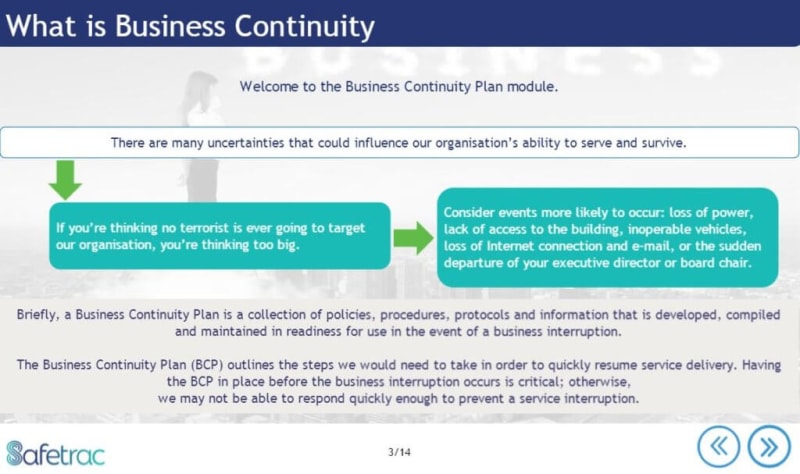

A Business Continuity Plan is a collection of policies, procedures, protocols and information that is developed, compiled and maintained in readiness for use in the event of a business interruption.

Companies that have a strong continuity program in place and train staff in understanding the program can realise a number of benefits – from getting the business up and running as soon as possible to staff health and well-being

On completing this course, learners should understand:

- what a Business Continuity Plan is & why it’s important;

- how to identify mission-critical services and determine the maximum acceptable downtime;

- how to isolate the business functions that are required to support mission-critical services & rate the function’s level of importance;

- how to conduct a Business Impact Analysis; and

- what methods can be employed to test the Business Continuity Plan.

- What Business Continuity is & why it’s required

- Identification of mission-critical services

- Relating service delivery to the business function

- Conducting a Business Impact Analysis

- Developing & testing the Business Continuity Plan

- Evacuation & firewardens

- Business Continuity Plan awareness

Employees have a duty to comply with the policies and procedures, which outline processes used in their everyday work. This rests on the expectation that all staff behave ethically, responsibly and with integrity in their business dealings.

Safetrac’s ‘Code of Conduct’ course assists staff in identifying and resolving ethical issues, as well as providing them with an understanding of inappropriate or illegal activities

On completing this course, learners should be able to:

- identify and resolve ethical issues during their employment;

- understand what activities are illegal or inappropriate;

- identify conflicts of interest; and

- understand their obligations in respect of company property.

- Compliance management

- Ethical principles & scenarios

- Fraud in the workplace

- Misappropriation

- Falsifying company records

- Bribery

- Conflicts of interest

- Third parties

- Privacy and confidentiality

- Procurement and tenders

- Gifts & benefits

- Respecting company property

- Intellectual property

- Company property

A conflict of interest arises when private or personal interests conflict with your professional responsibilities. However, it is important that staff deal with any conflict of interest in the correct manner.

Training in this area can ensure staff are aware of how to handle conflicts of interest that may occur within the workplace, this encourages staff to prioritise or tackle personal and professional conflicting issues that have an impact on their work performance or tasks.

On completing this course, learners should:

- be able to understand what a conflict of interest is;

- understand how to deal with conflicts of interest; and

- understand the different situations where a conflict of interest could occur.

- What is a conflict of interest?

- Is it an actual or potential conflict of interest?

- How do conflicts of interest arise?

- What is a relevant conflict?

- What are third parties?

- Procurement and tenders

- What is bid-rigging?

- Gifts and benefits

As a business owner or employee, it is important that you understand your obligations, as well as the rights of consumers.

While consumer laws differ between jurisdictions, the principles remain similar. Where it’s relevant, local regulations and law aims to protect consumers and businesses from unfair business practices.

On completing this course, learners should be able to:

- understand obligations for employers and employees;

- identify misleading, deceptive or unconscionable conduct and the penalties that can be incurred;

- identify unfair business practices;

- understand anti-competitive conduct, arrangements and cartel conduct;

- understand ACCC enforcement of the Act (Australian course);

- provide procedures and guidelines to assist organisations in complying with their obligations;

- describe false, unsubstantiated or misleading representations;

- determine the difference between misleading conduct and misleading representation; and

- identify unfair contract terms.

- Misleading or deceptive conduct

- Country of origin representations

- Unconscionable conduct

- Unfair contract terms

- Consumer guarantees

- Consumer rights and remedies

- Defective products

- Products and services safety and information

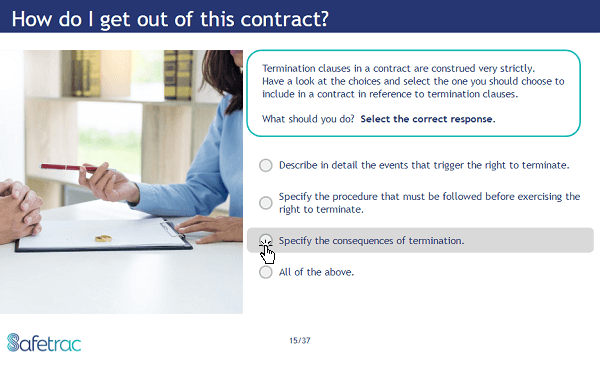

Contracts form the basis of all business transactions but, in reality, it is the source of much contention when something doesn’t go exactly to plan.

Safetrac’s course on ‘Contract Law’ provides you with the tools to better understand the principles of contract law and how to improve your organisation’s position in negotiating, managing and complying with contracts. It will help you ensure your contracts are negotiated effectively and that best practice is followed in contract management.

On completing this course, learners should be able to:

- understand the basic principles of contract law;

- outline best practice processes for negotiating, managing and complying with contracts; and

- understand the contract process.

- Oral and written contracts

- Offer and acceptance

- Consideration

- What does my contract consist of?

- Letters of intent, MOU and HOA’s

- The terms of my contract

- Liquidated damages and penalties

- So how do I get out of this contract?

- How do I manage risk and liability?

- Managing the contract

- Variation and procedure requirements

Prudential Standard CPS 520 applies to general insurers and authorised non-operating holding companies (NOHCs).

By training staff in CPS 520 standards, employees in the insurance industry are aware of what are expected of them under the Insurance Act 1973 and what information they are required to provide to the Australian Prudential Regulation Authority (APRA).

On completing this course, learners should:

- understand the minimum requirements for APRA-regulated institutions in determining the fitness and propriety of individuals;

- understand the information that must be provided to APRA regarding responsible persons fitness and propriety; and

- understand why institutions need to prudently manage the risk that persons in positions of responsibility might not be fit and proper.

- Key requirements of CPS 520

- Fit and Proper Policy

- Responsible persons regulated institutions

- Senior Managers

- Criteria to determine if a responsible person is fit and proper

- Other matters to consider to determine fitness and propriety

- Additional criteria applying to auditor and actuaries

- Decision standards for fitness and propriety considerations

- Fit and Proper Assessments

- Interim Appointments

- Assessments

- Adequate Provisions

- Legal considerations

- Whistleblowing

- When a responsible person is not fit and proper

- Notifying APRA

- APRA’s powers

Please leave your details should you like to preview this course.

On completing this course, learners should:

- have a general understanding of CPS 520 for Insurers

- To come

The Credit Contracts and Consumer Finance Act 2003 (CCCFA) is the most important piece of legislation governing consumer lending in New Zealand.

The CCCFA contains strict provisions regarding disclosure of information by creditors to consumers at the beginning and throughout the term of the consumer credit contract. Failure to comply with these can have very serious consequences for those involved.

On completing this course, learners should be able to:

- understand the CCFA, what it is and when it applies;

- know what is meant by responsible lending principles and conduct;

- understand disclosure standards and their requirements;

- be informed about ending and enforcing credit contracts; and

- understand the consequences of a breach.

- The law

- Criminal penalties for breach

- What does the CCCFA cover?

- When does the CCCFA apply?

- Responsible lending principles

- Responsible lending conduct

- Advertising to provide credit or finance

- Disclosure statements

- Substantial hardship

- Buy-back transactions

- Guarantees and guarantors

- Oppressive contracts

- More about the CCCFA

- Consumer leases

Major cyber-attacks are threatening computer systems, network and data around the world, disrupting operations from Mumbai to Melbourne, London to Los Angeles.

It is critical that all employees who access your organisation’s technology systems should have sufficient training and be able to identify potential security risks and know what action to take in the event of a security breach.

On completing this course, learners should be able to:

- recognise a security breach;

- know who to contact should a breach occur and how to minimise security breaches;

- recognise the required procedures for system accounts and authorisation; and

- guidelines for going about your business.

- What is IT security?

- Standard operating procedures

- How to recognise a security breach

- Malicious code infection

- Policies and Procedures

- Website access

- Electronic mail security

- Contracting a virus

- Spam

- Chain emails

- Other security requirements

- Guidelines

- System accounts

- Passwords

- Electronic mail accounts

- Remote access & data transfer

- Laptops and PDAs

Are your employees aware of the types of behaviour that are considered discriminatory?

Discrimination occurs when an employer takes adverse action against an employee or prospective employee because of a number of attributes including race, gender, age or religion. While discrimination laws differ between jurisdictions, the principles remain similar

On completing this course, learners should:

- understand the legal definition of discrimination;

- understand what behaviour is considered discriminatory; and

- understand the relevant anti-discrimination provisions

- The law

- Victimisation

- Defining discrimination

- Other ways to discriminate

- Areas of activity

- Discrimination at work

- Providing goods and services

- Direct and indirect discrimination

- Exceptions

- Providing special services

- Equal opportunity programmes

Anti-Bribery and Anti-Corruption

Anti-Bribery and Anti-Corruption Anti-Bullying and Anti-Harassment

Anti-Bullying and Anti-Harassment Anti-Competitive Conduct

Anti-Competitive Conduct Anti-Money Laundering and Counter-Terrorism Financing

Anti-Money Laundering and Counter-Terrorism Financing Anti-Money Laundering and Countering Financing of Terrorism

Anti-Money Laundering and Countering Financing of Terrorism Business Continuity Planning

Business Continuity Planning Code of Conduct

Code of Conduct Conflicts of Interest

Conflicts of Interest Consumer Protection and Unfair Business Conduct

Consumer Protection and Unfair Business Conduct Contract Law Course

Contract Law Course CPS 520 for Authorised Deposit Institutions

CPS 520 for Authorised Deposit Institutions CPS 520 for Insurers

CPS 520 for Insurers Credit Contracts and Consumer Finance

Credit Contracts and Consumer Finance Cyber Security Awareness

Cyber Security Awareness Discrimination Prevention

Discrimination Prevention