Robert Kiyosaki's "Rich Dad Poor Dad," a best-seller with around 40 million copies sold, provides a straightforward narrative about two contrasting father figures and their financial philosophies. It delves into the behaviors of wealthy individuals and offers insights on how to accumulate and preserve wealth. Despite its apparent simplicity, the book resonates because it imparts fundamental principles often overlooked in traditional education, such as distinguishing between assets and liabilities. Many readers can relate to personal experiences of spending windfalls on non-appreciating assets, like cars and extravagant houses.

"Think and Grow Rich" by Napoleon Hill, published in 1937 and having sold millions of copies, aims to reveal the secrets of success. It begins with Hill's claim of having interviewed thousands of successful individuals, including Andrew Carnegie. While the book emphasizes positive thinking and persistence, some find its advice somewhat vague. Nevertheless, the importance of maintaining a positive mindset and persevering through challenges resonates with readers.

The "Psychology of Money" underscores the significance of adopting the right mindset when it comes to finances. The book explores various aspects of money, including saving, budgeting, investing, and retirement planning. It offers practical advice without overwhelming readers with financial jargon. One of its key lessons is the value of controlling one's time, emphasizing the importance of patience and discipline.

The key lesson from "The Simple Path to Wealth" is straightforward: spend less than what you earn and invest the surplus. While this concept may seem simple, its true power lies in consistently applying it over many years. It's not a quick route to wealth; instead, it's a long-term marathon. Many individuals seek shortcuts to financial success, hoping to get rich quickly. However, a deeper understanding of the financial landscape reveals that achieving lasting financial security and wealth requires patience and discipline. Therefore, having a firm grasp of the basics and practicing them diligently cannot be emphasized enough.

"Pete Matthews' Meaningful Money Handbook" provides a UK-focused guide on personal finance, covering topics like saving, budgeting, investing, and retirement planning. It fills a gap in the market for UK-centric financial advice and offers valuable insights for those seeking to strengthen their financial foundation.

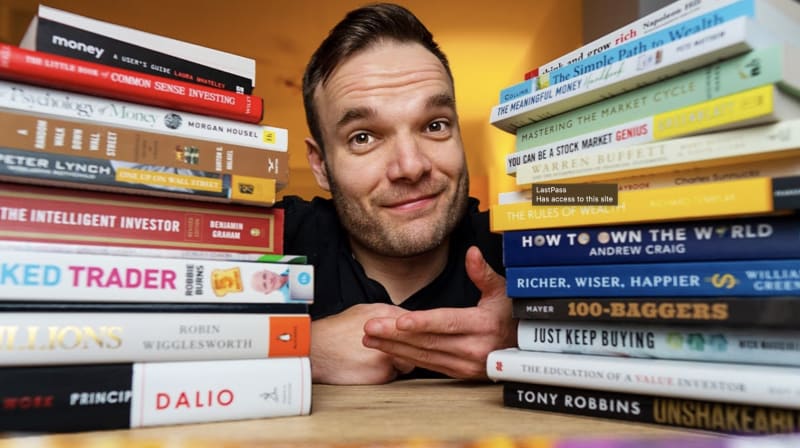

Rich Dad Poor Dad

Rich Dad Poor Dad Think and Grow Rich

Think and Grow Rich The Psychology of Money

The Psychology of Money The Simple Path to Wealth

The Simple Path to Wealth The Meaningful Money Handbook

The Meaningful Money Handbook Money A User's Guide

Money A User's Guide The Intelligent Investor

The Intelligent Investor One Up on Wall Street

One Up on Wall Street Mastering the Market Cycle

Mastering the Market Cycle You Can Be A Stock Market Genius

You Can Be A Stock Market Genius A Random Walk Down Wall Street

A Random Walk Down Wall Street The Little Book of Common Sense Investing

The Little Book of Common Sense Investing