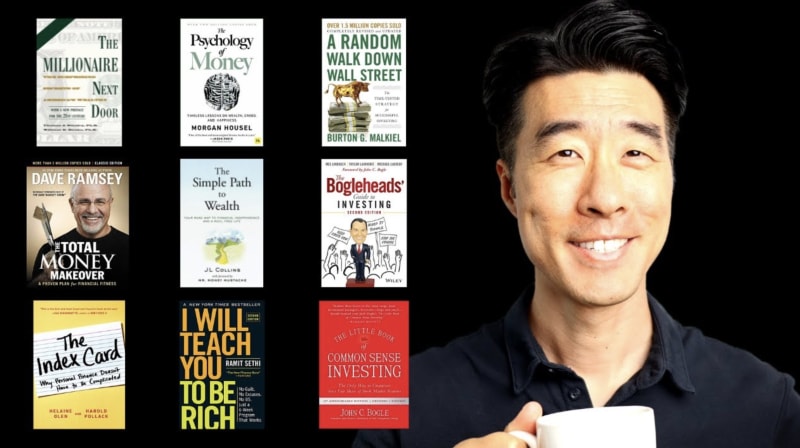

The book "The Millionaire Next Door" by Dr. Thomas Stanley is based on a survey of real American millionaires, aiming to reveal their true characteristics rather than the glamorous images portrayed in media. One key lesson is that genuine millionaires prioritize financial independence over ostentatious displays of wealth. In a world driven by social media and materialism, the book highlights that real financial success involves living within one's means, planning for the future, and valuing freedom over extravagant spending. This mindset allows millionaires to maintain stability even in challenging economic times, in contrast to those who live beyond their means for appearances. For insights into the psychology and traits of actual millionaires, the book is recommended reading.

The Psychology of Money by Morgan Housel challenges the common belief that financial success is solely based on knowledge. Instead, Housel emphasizes that behavior and decision-making play a vital role. Contrary to the idea that financial decisions are purely analytical, driven by data and formulas, Housel delves into the reality that emotions, personal history, culture, and worldviews heavily influence our money choices. The book explores the complexity of money decisions, considering factors such as emotions, personal history, culture, advertising, and psychology.

The Index Card: Why Personal Finance Doesn't Have to Be Complicated by Helaine Olen and Harold Pollack challenges the notion perpetuated by the financial industry that personal finance is complex and requires their specific guidance. The authors assert that this belief is misleading. The book originated from a suggestion made by University of Chicago Professor Harold Pollack, who argued that all the essential principles of managing money could fit on an index card.

If you're seeking a concise and easily digestible read that imparts valuable money lessons, this book is recommended. It provides a straightforward approach to personal finance that can fit on an index card, challenging the misconception that financial success requires convoluted strategies.

Total Money Makeover by Dave Ramsey is a highly recommended book, especially for those who are starting their personal finance journey and need clear guidance. The book presents a straightforward and simple game plan for transforming one's financial habits. It has been impactful for the author, who, over the course of three and a half years, managed to pay off a substantial amount of student loan debt.

One of the key themes of the book is debt. Dave Ramsey takes a strong stance against debt, urging readers to be cautious when borrowing money. While the author might be at the extreme end of advocating for a debt-free life, the book emphasizes the danger of normalizing debt and the potential slippery slope it creates. The book cautions against the mindset of justifying debt for an elevated lifestyle, even if it begins with seemingly low-interest mortgages or home equity lines of credit.

The Little Book of Common Sense Investing by Jack Bogle is a testament to the legacy of its author, who founded Vanguard and pioneered the concept of low-cost index funds. Despite his passing in 2019, Bogle's influence on the investment world remains profound. He revolutionized the mutual fund industry by introducing index funds, allowing individual investors to access diversified exposure to the stock market at minimal cost. What sets this book apart is its focus on empowering investors without the need for intermediaries or unnecessary financial products.

I recommend The Bogleheads' Guide to Investing. The Bogleheads are a group of investment enthusiasts who uphold the principles of investing championed by Jack Bogle. They have a strong online presence and are known for their dedication to diversification, index funds, and long-term investment strategies.

The Bogleheads' Guide to Investing is a book authored by three passionate Boglehead enthusiasts. It covers a comprehensive range of investment topics and provides practical advice for managing personal finances. From understanding your financial lifestyle to maintaining emotional balance in investing, the book offers insights into mastering investment decisions. It even delves into aspects like investing for your children's education.

I highly recommend A Random Walk Down Wall Street by Burton G. Malkiel. First published in 1973 and updated periodically, this book remains a cornerstone in the field of investing. Burton Malkiel, a Princeton economist known for his work on the efficient market hypothesis, delves into the concept of market efficiency, where stock prices reflect current information and adjust with new developments.

The book covers a wide array of investment vehicles, from stocks and bonds to real estate and tangible assets. It offers a comprehensive overview of the stock market, Wall Street, and the investment industry. A unique feature is the chapter on behavioral finance, exploring how emotions influence financial decisions.

I Will Teach You to Be Rich by Ramit Sethi is a comprehensive guide aimed at young professionals, particularly those with medium to high incomes. The book covers fundamental aspects of personal finance, including banking, saving, budgeting, and investing. Sethi's approach is distinctive, encouraging behaviors that challenge conventional advice, such as enjoying indulgences like lattes without guilt.

Sethi offers sound advice for growing one's net worth, addressing topics like eliminating student loans and debt, crafting an effective spending plan, and preparing for significant life expenses such as weddings or home purchases. He dedicates a chapter to investing, outlining what he terms a "pyramid of investing." This framework allows individuals to choose their level of involvement, ranging from hands-on management to more passive approaches. He discusses investment options such as target-date funds, index funds, mutual funds, and even single stocks.

A Simple Path to Wealth by J.L. Collins offers a unique perspective on financial wisdom. Initially intended as a series of letters to his daughter, Jim Collins turned these insights into a comprehensive financial guide. He believes money is a potent tool for navigating life and aims to help others understand and master it as a crucial life skill.

The book simplifies financial lessons, a response to his daughter's sentiment that, while money matters, she didn't want to spend her life fixated on it. Collins covers a range of topics, including debt, how the stock market functions, and investing in both favorable and challenging times.

A particularly powerful aspect of the book is its focus on simplicity in investment strategy. The author's own journey led him to streamline his approach, ultimately adopting a two-fund strategy. His philosophy resonated with readers, encouraging many to simplify their own investment approaches.

The Millionaire Next Door

The Millionaire Next Door The Psychology of Money

The Psychology of Money The Index Card

The Index Card The Total Money Makeover

The Total Money Makeover The Little Book of Common Sense Investing

The Little Book of Common Sense Investing The Boglehead's Guide to Investing

The Boglehead's Guide to Investing A Random Walk Down Wall Street

A Random Walk Down Wall Street I Will Teach You To Be Rich

I Will Teach You To Be Rich The Simple Path to Wealth

The Simple Path to Wealth